Fast Facts: Tax ID Theft Tops FTC Complaints in 2014 (List and Infographic)

From the Federal Trade Commission:

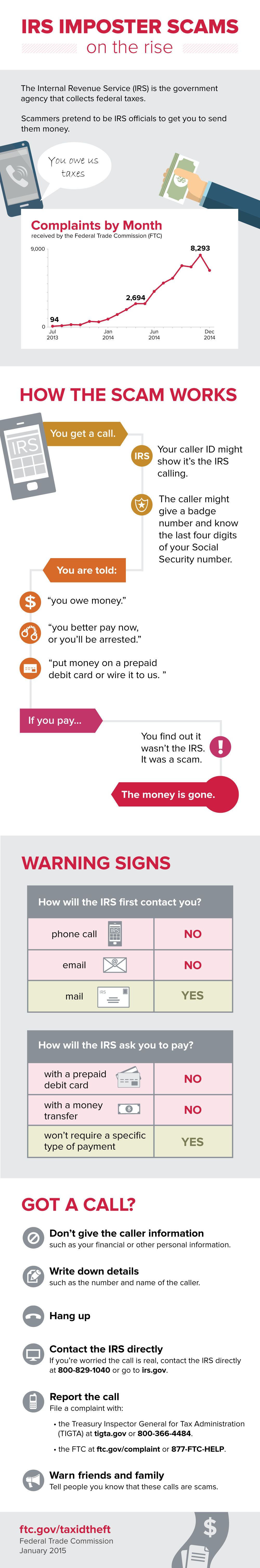

Tax-related identity theft was the most common form of identity theft reported to the Federal Trade Commission in 2014, while the number of complaints from consumers about criminals impersonating IRS officials was nearly 24 times more than in 2013, according to FTC statistics released today.

[Clip]

The statistics released today come from the FTC’s Consumer Sentinel database, which accounts for complaints received by the FTC and other federal, state and local law enforcement and consumer protection agencies. In 2013, the FTC received 2,545 complaints about IRS imposter scams; in 2014 that number increased to 54,690. In 2014, the FTC received 109,063 complaints about tax identity theft, accounting for 32.8 percent of the 332,646 overall complaints about identity theft.

Tax identity theft typically happens when a scammer files a fraudulent tax return using a consumer’s Social Security number in order to receive a refund. The year 2014 marks the fifth consecutive year in which tax-related identity theft topped the list of identity theft complaints, with tax identity theft accounting for nearly a third of all identity theft complaints to the FTC.

Additional Info in the Complete News Release

Filed under: News

About Gary Price

Gary Price (gprice@gmail.com) is a librarian, writer, consultant, and frequent conference speaker based in the Washington D.C. metro area. He earned his MLIS degree from Wayne State University in Detroit. Price has won several awards including the SLA Innovations in Technology Award and Alumnus of the Year from the Wayne St. University Library and Information Science Program. From 2006-2009 he was Director of Online Information Services at Ask.com.